Contents Show

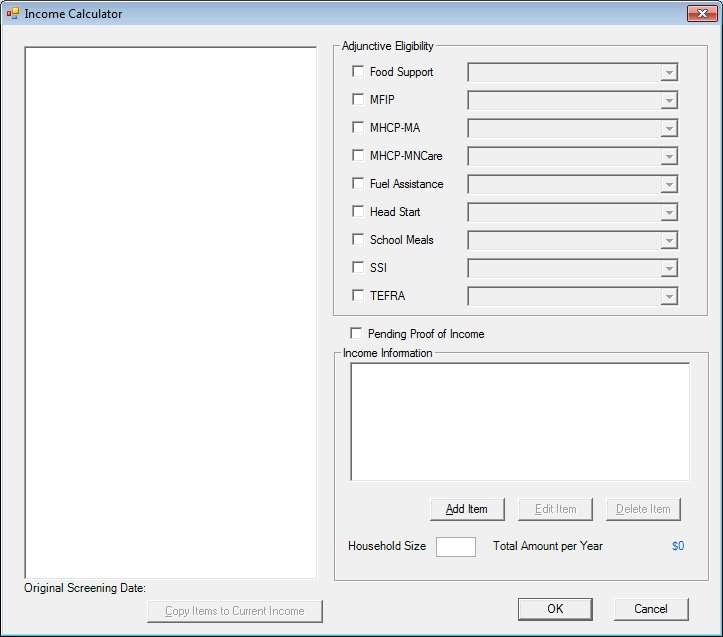

The Income Calculator screen is used to manage income eligibility information for the current client.

When an applicant is prescreened into a household for which an income contact exists for the current system date, the household income contact information is copied to the applicant's records when the prescreening process is complete.

A record is created for the applicant in the INCOMECONTACT database table. The CERTSTARTDATE value is set to NULL.

If one or more household Adjunctive Eligibility records exist for the income contact, a record is created for each in the INCOMECONTACTADJUNCTIVEITEM database table for the applicant.

Individual Adjunctive Eligibility records that exist for the income contact are not saved for the member, but the Medicaid individual Adjunctive Eligibility option is a special case. If a member of the household with a WIC status of Pregnant or Infant has it assigned, it is treated as a household Adjunctive Eligibility option, and a record is created in the INCOMECONTACTADJUNCTIVEITEM database table for the applicant.

If one or more Income line item records exist for the income contact, a record is created for each in the INCOMEITEM database table for the applicant.

Income items added to the Adjunctive Income Eligibility Maintenance screen in Reference Utility can also apply to all members of the household (depending on the selections made by the user).

When a certification attempt is started for a member of a household for which an income contact exists for the current system date, the CERTSTARTDATE value of the member's INCOMECONTACT record is changed to the CERTSTARTDATE value of the member's CERTCONTACT record (which will be the current system date).

When an incomplete certification is removed using the Remove Incomplete Certification menu option on the Certification menu in the Participant Folder of the Clinic application module:

INCOMECONTACTADJUNCTIVEITEM records for the current screening date are removed. (Exception: If Medicaid is one of the adjunctive items, and that item is assigned to another member for the current screening date who has a WIC Category of Pregnant or Infant, that adjunctive item is not removed.

The CERTSTARTDATE value of the member's INCOMECONTACT record is changed to NULL.

Income Calculator screen

|

|

Interface InitializationUpon initial display of the screen, the following occurs:

If the screen is displayed from the Applicant Prescreening screen:

For information about the maintenance of adjunctive income eligibility options, refer to Adjunctive Income Eligibility Maintenance in Reference Utility.

If the screen is displayed from the Income History screen of the Participant Folder or the Demographics screen of the Certification Guided Script:

If each check box is enabled:

The Medicaid option is a special case. It applies to individuals, but if it is selected for a household member with a WIC Category of Pregnant or Infant, it is applied to each member of the household. A drop-down list box associated with a selected check box is enabled and displays the last value saved for the current income screening contact. A drop-down list box associated with a clear check box is disabled and defaults to unchecked. For information about the maintenance of adjunctive income eligibility options, refer to Adjunctive Income Eligibility Maintenance in Reference Utility.

|

Unless otherwise stated below, all controls on the Income Calculator screen are visible and enabled when:

The screen is active.

If one or more special conditions exist that affect a control on the Income Calculator screen, the condition(s) are documented for that specific control below.

View items in the Income Screening Contacts tree list.

This tree list displays all income screening contacts for the participant's household sorted by date in descending order (when such data exists).

Click an item in the tree list to select it. The tree list is single select. Click the plus sign  next to an item to expand the tree list and view the details of the item. Click the minus sign

next to an item to expand the tree list and view the details of the item. Click the minus sign  next to an item to collapse the tree list and hide the details of the item. The data values in the tree list are read-only.

next to an item to collapse the tree list and hide the details of the item. The data values in the tree list are read-only.

The root node displays the following icon and the text:

Income Screening Contacts

Income Screening Contacts

Income screening contact data recorded for the household is displayed in two types of nodes when the screen is displayed from the Income History screen in the Participant Folder or the Demographic Information screen of the Certification Guided Script:

Income Screening Contact nodes - display under the root node and are organized in descending order by screening date.

Individual Adjunctive Income Eligibility Option nodes - display under Income Screening Contact nodes for each individual Adjunctive Eligibility option recorded for each household member during the contact.

No data is displayed when the screen is displayed from the Applicant Prescreening screen.

When the income screening contact for the current system date is selected, the controls on the right side of the screen are enabled to allow the recording of income information. When a previous income screening contact is selected, the controls on the right side of the screen are disabled and display information recorded for the income contact.

When an Income Screening Contact node for a previous date is selected, the controls on the right side of the screen are populated with the data collected for the previous income screening contact. In addition:

The Original Screening Date value label defaults to the original screening date recorded for the previous income contact.

The Copy Items to Current Income button is enabled if:

The ENABLECOPYINCOME state business rule is set to "Y".

The Original Screening Date of the selected income screening contact falls within the number of days of the current screening date specified by the DAYSALLOWINCOMECOPY state business rule.

The Adjunctive Eligibility group box includes an Adjunctive Eligibility Option check box and Proof of Adjunctive Eligibility drop-down list box combination for each active adjunctive income eligibility option and each inactive adjunctive income eligibility option that was selected for the previous income contact:

Each check box is disabled:

If the Adjunctive Eligibility Option check box applies to individuals only, the check box displays the value saved for the household member for the previous income screening contact.

If the Adjunctive Eligibility Option check box applies to the household, the check box displays the value saved for the household for the previous income screening contact.

|

|

NOTE: The Medicaid option is a special case. It applies to individuals, but if it was selected for a household member with a WIC Category of Pregnant or Infant, it is applied to each member of the household. |

Each drop-down list box is disabled and displays the value saved for the previous income screening contact.

|

|

NOTE: For information about the maintenance of adjunctive income eligibility options, refer to Adjunctive Income Eligibility Maintenance. |

The Pending Proof of Income check box is disabled and displays the value saved for the household for the previous income screening contact, or defaults to unchecked if no value has been saved. If the CLN_AllowPendingProof_Income business rule is set to "N", the Pending Proof of Income check box is always disabled.

The Income Information data grid is disabled and displays a row for each income line item added for the household for the previous income screening contact.

The Add Item button is disabled.

The Edit Item button is disabled.

The Delete Item button is disabled.

The Household Size text box is disabled and displays the value saved for the household for the previous income screening contact.

The Total Amount per {Period} text label displays as defined, and the value label displays the total value of income line item(s) included in the Income Information data grid.

The OK button is disabled.

The Cancel button is enabled.

The node displays the following icon and income screening contact data:

{Screening Date}, {Total Income Amount}, {Household Size}, {Income Proofs}

{Screening Date}, {Total Income Amount}, {Household Size}, {Income Proofs}

Screening Date - The date on which the income screening contact was recorded for the household. It is in the format, "MM/DD/CCYY"

Total Income Amount - The sum of the income line item(s) recorded for the income contact. It is in the format, "$###,###.##/{period}" where period is, "Year," "Month," or "Week," as specified by the value of the INCOMEVIEWFREQ state business rule ("1", "12", and "52" respectively).

Household Size - The size recorded for the household at the time of the income contact. It is in the format, "HH Size: {HHS}" where HHS is the value entered in the Household Size text box.

Income Proofs - All income proofs compiled from Proof of Income value selected for the income line item(s) added to the income screening contact. It is in the format, "Proof: {IncomeProofs}" where IncomeProofs is all income proofs separated by semicolons.

Below is an example of the data displayed for an income screening contact node:

Individual Adjunctive Income Eligibility Option node

The node displays the following icon and individual adjunctive income eligibility data:

{Participant Name} {Individual Adjunctive Eligibility Option}

{Participant Name} {Individual Adjunctive Eligibility Option}

Participant Name - The name of the household member for whom the individual adjunctive eligibility option was selected during the income screening contact. It is in the format, "{First Name} {MI[.]} {Last Name}" The period after the middle initial is only displayed if the middle initial exists.

Individual Adjunctive Eligibility Option - The name of the individual adjunctive eligibility option that was selected for the named household member. It is in the format, "Individual Adjunctive Eligibility: {IAEP}" where IAEP is the name assigned to the adjunctive eligibility option.

Below is an example of the data displayed for an individual adjunctive income eligibility item node:

View the original screening date recorded for an income screening contact node selected in the Income Screening Contacts tree list in the Original Screening Date text and value label.

Click the Copy Items to Current Income button to copy an income item selected in the Income Screening Contacts tree list to the Current Income Information data grid.

It has a mnemonic of "C".

When the Copy Items to Current Income button is clicked for a selected previous income screening contact the following processes are started:

Verify Conflicts with Current Income Eligibility Options

A check is completed for the following conditions:

If inactive adjunctive income eligibility options are included in the selected previous income screening contact, a standard informational screen is displayed with the text, "The selected income screening contact includes inactive adjunctive items. The inactive adjunctive items won't be copied to the current income screening contact." When the screen is dismissed, the copy process continues.

If income information has already been recorded for the current income contact, the system displays the C0010 standard confirmation message.

Click the Yes button to continue the copy process.

Click the No button to cancel the copy process.

Copy Income Information Forward

Once the previous edits are completed successfully, the copy process continues:

The Original Screening Date of the previous income screening contact is copied as the Original Screening Date of the current income screening contacts of all members.

Household adjunctive eligibility options recorded for the previous income screening contact are copied to the current income screening contacts of all household members.

Individual adjunctive eligibility options recorded for the previous income screening contact are copied to the current income screening contact of the household members for whom they were originally selected.

|

|

NOTE: Although the Medicaid is an individual adjunctive income eligibility option, it acts as a household adjunctive income eligibility option when it is applied to a participant with a WIC Category of Pregnant or Infant. So, if Medicaid would be copied forward for a participant who currently has a WIC Category of Pregnant or Infant, it is copied forward to the income screening contacts for all household members. |

The Pending Proof of Income value recorded for the previous income screening contact is copied to the current income screening contact of all household members.

Income line items recorded for the previous income screening contact are copied to the current income screening contacts of all household members.

The Household Size recorded for the previous income screening contact is copied to the current income screening contacts of all household members.

The node for the current income screening contact in the Income Screening Contacts tree list is selected and updated to display the data copied from the previous income contact. The node is expanded if individual adjunctive eligibility options have been coped forward for a member of the household.

Complete the information in the Adjunctive Eligibility group box.

Check the check boxes to indicate that the members of the household participate in programs and are adjunctively eligible for WIC participation. Then, select the proof of program enrollment from the drop-down list box for each adjunctive eligibility option checked.

|

|

NOTE: For information about the maintenance of adjunctive income eligibility options, refer to Adjunctive Income Eligibility Maintenance. |

When a Proof of Adjunctive Eligibility is selected for the Adjunctive Eligibility Option, the addition of adjunctive eligibility proof is complete.

If a check box under Adjunctive Eligibility is selected, a selection is required in the associated Proof of Adjunctive Eligibility drop-down list box.

Adjunctive Eligibility Option check box

The control allows the selection of the adjunctive income eligibility option and displays the name specified for it. If the check box is enabled, selecting the check box indicates the household member's participation in the program and provides the member and possibly the member's entire household adjunctive income eligibility in the local WIC program. Checking a check box enables the associated Proof of Adjunctive Eligibility drop-down list box. Unchecking a check box disables the associated Proof of Adjunctive Eligibility drop-down list box and clears its selection, if any.

When an adjunctive eligibility option that applies only to individuals is selected, a new Individual Adjunctive Income Eligibility Option node for the current household member is added to the Income Screening Contacts tree list under the Income Screening Contact node for the current system date.

|

|

NOTE: The Medicaid option is a special case. It applies to individuals, but if it is selected for a household member with a WIC Category of Pregnant or Infant, it is applied to each member of the household. A new Individual Adjunctive Income Eligibility Option node for all household members is added to the Income Screening Contacts tree list under the Income Screening Contact node for the current system date. If it is cleared for a household member with a WIC Category of Pregnant or Infant during the same session in which it was added, it is removed from each member of the household to which it was added. If it is cleared for a household member with a WIC Category of Pregnant or Infant, during a different session from which it was added, it is removed from only that individual. The associated Individual Adjunctive Income Eligibility Option nodes for any affected household members are removed from under the Income Screening Contact node for the current system date in the Income Screening Contacts tree list. |

When a check box is selected for an Adjunctive Eligibility Option that is defined as being applicable to the entire household (The INDIVIDUALONLY value in the ADJUNCTIVEINCOMEELIGIBILITY table that matches the NAME of the option selected must = "N"), and Proof of Adjunctive Eligibility drop-down list box associated with the check box contains a value, the household is adjunctively income eligible for participation in the WIC program.

When a check box is selected for an Adjunctive Eligibility Option that is defined as being applicable to the household member only (The INDIVIDUALONLY value in the ADJUNCTIVEINCOMEELIGIBILITY table that matches the NAME of the option selected must = "Y"), and Proof of Adjunctive Eligibility drop-down list box associated with the check box contains a value, the household member is adjunctively income eligible for participation in the WIC program.

Proof of Adjunctive Eligibility drop-down list box

The control allows the selection of a proof of participation in the selected Adjunctive Eligibility Option.

The control is enabled when:

The associated Adjunctive Eligibility Option check box is checked.

It is populated with all participation proofs to be selected.

Select the Pending Proof of Income check box to indicate the client has neither proof of participation in an Adjunctive Eligibility program nor proof of income for the Income Information.

The control is enabled when:

The CLN_AllowPendingProof_Income business rule is set to "Y".

If this check box is checked, it updates all other household members to be pending proof of income. When proof of income is obtained and this check box is unchecked, it updates the proof of income for all other household members.

Complete the information in the Income Information group box.

Click an income record in this data grid to select it for editing or deleting. This data grid displays all income records for the client. The following are associated with this data grid:

Income Information data grid

The control displays income recorded for the income screening contact. A row is displayed in the data grid for each income line item. The data grid includes the following columns:

When income line items have been recorded for the household (all income line items displayed in the Income Information data grid apply to the entire household), the values of all income line items added for the income screening contact are totaled and compared to the federal guidelines for income established for the current fiscal year, based on the size of the household and the value of the INCOMEVIEWFREQ state business rule. The income thresholds are stored in the INCOMEELIGIBILITYAMOUNT table.

For example, if the fiscal year is 2010, the household size is three, and the INCOMEVIEWFREQ state business rule is one (Yearly), the sum of all income line items is compared to the ANNUALAMOUNT value in the INCOMEELIGIBILITYAMOUNT table where the FISCALYEAR value is "2010" and the HOUSEHOLDSIZE value is "3". If the sum of all income line items for the income screening contact is less than or equal to the ANNUALAMOUNT value, the household is income eligible for participation in the WIC program. However, if the sum of all income line items for the income screening contact is greater than the ANNUALAMOUNT value, the household is income ineligible for participation in the WIC program.

The data grid consists of the following control(s):

Frequency column

This column displays the frequencies selected for the income line items for each record displayed within the data grid.

The title of the column is set to "Frequency". The information displayed within the column is read-only.

The following values are valid (as defined in the Reference Dictionary where the category = INCOMFREQD):

Weekly

Monthly

Bi-weekly

Semi-monthly

Yearly

Description column

This column displays the description for each record displayed within the data grid.

The title of the column is set to "Description". The information displayed within the column is read-only. The column header and the data within the column are left aligned.

The cells in the column display the descriptions of the income line items. The following formats are valid (as defined in the Reference Dictionary where the category = INCOMFREQ):

Hourly - "## hours at $##.##/hour for ## week(s)"

Weekly - "$#,###.##/week for ## week(s)"

Monthly - "$#,###.##/month for ## month(s)"

Bi-weekly - "$#,###.##/period for ## period(s)"

Semi-monthly - "$#,###.##/period for ## period(s)"

Yearly - "$#,###.##/year"

|

|

NOTE: The values displayed in place of the pound (#) symbols are the values stored for the income line items and are collected when the income line items are added or edited on the Income Line Item screen. |

Amount per {Period} column

This column displays the total amount calculated for the income line items rounded to the nearest whole dollar displayed within the data grid.

The title of the column is set to "Amount per {Period}". The information displayed within the column is read-only.

The text displayed for the column heading is determined by the value of the INCOMEVIEWFREQ state business rule. If the value of the business rule is "1", the text displayed is "Amount per Year". If the value of the business rule is "12", the text displayed is "Amount per Month". If the value of the business rule is "52", the text displayed is "Amount per Week". The following calculations are defined for the indicated frequencies:

Hourly - {amount per hour} * {hours per week} * {number of weeks}

Weekly - amount per week} * 52 / {INCOMEVIEWFREQ value}

Monthly - {amount per month} * 12 / {INCOMEVIEWFREQ value}

Bi-weekly - {amount per period} * 26 / {INCOMEVIEWFREQ value}

Yearly - {amount per year} / {INCOMEVIEWFREQ value}

|

|

NOTE: The Number of Weeks, Number of Months, and Number of Periods values are static values when the INCOMEVIEWFREQ state business rule is set to "12" or "52" and are determined by the same. |

Add Item button

Click the Add Item button to add an income record.

It has a mnemonic of "A".

The Income Line Item screen displays in Add mode when the button is clicked.

Upon successful processing of the Income Line Item screen, an income line item is added for the current income screening contact.

When an income line item is added, the following actions occur:

The Income Screening Contact node for the current system date is updated to display a recalculated total income for the household and the proof of income selected for the income line item.

The Income Information data grid is updated to display a row for the added income line item.

The Total Amount per {Period} value label updates to display the total value of the income line item included in the Income Information data grid.

The Total Eligibility Amount per (Period) value label updates to display the total value of the income line item included in the Income Information data grid.

Edit Item button

Click the Edit Item button to edit the income item selected in the data grid.

The control is enabled when:

A record is selected in the data grid.

It has a mnemonic of "E".

The Income Line Item screen displays in Edit mode when the button is clicked.

When the income screening contact for the current system date is edited, the Original Screening Date value is set to the current system date.

Upon successful processing of the Income Line Item screen, the selected income line item is updated for the current income screening contact.

When an income line item is edited, the following actions occur

The Income Screening Contact node for the current system date is updated to display a recalculated total income for the household and the proof of income selected for the income line item.

The row for the income line item in the Income Information data grid is updated to display the change.

The Total Amount per {Period} value label updates to display the total value of the income line item included in the Income Information data grid.

The Total Eligibility Amount per (Period) value label updates to display the total value of the income line item included in the Income Information data grid.

Delete Item button

Click the Delete Item button to delete an income item selected in the data grid.

The control is enabled when:

A record is selected in the data grid.

It has a mnemonic of "D".

A standard confirmation message (C0004) displays when the button is clicked. The options of Yes and No are available. If the user clicks Yes, the system deletes the record from the database. The contents on the Income Calculator screen are refreshed. If the user clicks No, the system returns to the Income Calculator screen without deleting the selected record.

When an income line item is deleted, the following actions occur:

The Income Screening Contact node for the current system date is updated to display a recalculated total income for the household and to remove the proof of income selected for the income line item.

The row for the income line item is removed from the Income Information data grid.

The Total Amount per {Period} value label updates to display the total value of the income line item included in the Income Information data grid.

The Total Eligibility Amount per (Period) value label updates to display the total value of the income line item included in the Income Information data grid.

Household Size masked edit box

Enter the number of members in the client's household.

The Household Size value must be between 1 and 20.

Total Amount per {Period} text and value label

The text and value label displays the period for which the household income is totaled and the calculated total household income amount. The text displayed for the value label is determined by the value of the INCOMEVIEWFREQ state business rule. If the value of the business rule is "1", the text displayed is "Total Amount per Year". If the value of the business rule is "12", the text displayed is "Total Amount per Month". If the value of the business rule is "52", the text displayed is "Total Amount per Week".

The value label displays the sum of the values displayed in the Total Amount per {Period} column in "$###,###.##" format.

The information displayed is read-only. The value label displays in the inverse color of the screen.

Click the OK button to process the screen.

It is the default button for the screen, unless otherwise noted.

It does not have a mnemonic. Its keyboard shortcut is the Enter key.

Depending on which screen originally called the Income Calculator screen, one of the following screens displays when the button is clicked:

Applicant Prescreening screen

Income History screen

Demographics screen

A check is performed to ensure required information is provided for the current income screening contact:

One of the following must be true for the income information:

A check box under Adjunctive Eligibility must be selected, and the Proof of Adjunctive Eligibility drop-down list box associated with the check box must contain a value.

The Pending Proof of Income check box must be selected.

The Income Information data grid must include a row for an income line item.

If none of the three conditions are true for the income information, the system displays the E0061 standard error message.

When the above income eligibility checks are completed, the following occurs:

If the Income Contact was displayed from the Applicant Prescreening screen:

If neither the household nor the household member is income eligible (adjunctively, presumptively, or by federal guidelines), a standard informational screen is displayed with the text, "Applicant is over income." When the OK button is clicked, the Income Calculator screen is dismissed, and focus is returned to the Applicant Prescreening screen. The income screening contact data is not saved.

If the household or the household member is income eligible (adjunctively, presumptively, or by federal guidelines), a standard informational screen is displayed with the text, "Applicant meets income guidelines." When the OK button is clicked, the Income Calculator screen is dismissed, and focus is returned to the Applicant Prescreening screen. The income screening contact data is not saved.

If the Income Contact was displayed from the Income History screen of the Participant Folder or the Demographics screen of the Certification Guided Script:

If the household and the household member are not income eligible (adjunctively, presumptively, or by federal guidelines), the system displays the W0004 standard warning message. When the No button is clicked, the standard warning message is dismissed and focus is returned to the Income Calculator screen. When the Yes button is clicked:

The standard warning message is dismissed.

The applicant and all members of the household without individual adjunctive income eligibility who have not completed their certification are marked as ineligible for participant in the WIC program due to Over Income.

The applicant and all members of the household without individual adjunctive income eligibility who are in a valid certification are terminated from participation in the WIC program due to Over Income.

The Income Calculator screen is dismissed.

The income screening contact data is saved.

If the household is not income eligible (adjunctively, presumptively, or by federal guidelines) but the household member is (by individual adjunctive income eligibility), the system displays the W0005 standard warning message. When the No button is clicked, the standard warning message is dismissed and focus is returned to the Income Calculator screen. When the Yes button is clicked:

The standard warning message is dismissed.

All members of the household without individual adjunctive income eligibility who have not completed their certification are marked as ineligible for participant in the WIC program due to Over Income.

All members of the household without individual adjunctive income eligibility who are in a valid certification are terminated from participation in the WIC program due to Over Income.

The Income Calculator screen is dismissed.

The income screening contact data is saved.

When the edits are completed successfully, if the Income Calculator screen was displayed from the Income History screen of the Participant Folder or the Demographics Information screen of the Certification Guided Script, the income contact information is saved.

If a new income contact was created, the following occurs:

The income screening contact information is saved for the current member.

A record is created for the member in the INCOMECONTACT database table. If the income contact is created through the Demographic Information screen of the Certification Guided Script, the CERTSTARTDATE is set to the value of the CERTSTARTDATE column in the CERTCONTACT database table for the member's current certification attempt. If the income contact is created through the Income History screen of the Participant Folder, the CERTSTARTDATE value is set to NULL.

If one or more Adjunctive Eligibility options are selected, a record is created for each selection in the INCOMECONTACTADJUNCTIVEITEM database table.

If one or more income line items are added, a record is created for each income item in the INCOMEITEM database table.

The income screening contact information is saved for all other household members.

A record is created in the INCOMECONTACT database table for each household member. If the member is in a valid certification completed on the current system date, the CERTSTARTDATE is set to the value of the CERTSTARTDATE column in the CERTCONTACT database table for the member's current certification. If the member is in the process of completing a certification attempt, the CERTSTARTDATE is set to the value of the CERTSTARTDATE column in the CERTCONTACT database table for the member's current certification attempt. If the member is in a valid certification completed on a previous date, the CERTSTARTDATE value is set to NULL. If the member is not in a valid certification, the CERTSTARTDATE value is set to NULL.

If one or more household Adjunctive Eligibility options are selected, a record is created for each selection in the INCOMECONTACTADJUNCTIVEITEM database table for each household member.

Individual Adjunctive Eligibility options selected for the member are not saved for other members of the household, but the Medicaid individual Adjunctive Eligibility option is a special case. If the member for whom it is selected has a WIC status of Pregnant or Infant, it is treated as a household Adjunctive Eligibility option, and a record is created in the INCOMECONTACTADJUNCTIVEITEM database table for each household member.

All individual Adjunctive Eligibility records assigned to household members for the previous income screening contact are copied forward for those household members to whom they were assigned.

If one or more Income line items are added, a record is created for each income item in the INCOMEITEM database table for each household member.

The Income Contact screen is dismissed, and focus is returned to the Income History screen of the Participant Folder or the Demographic Information screen of the Certification Guided Script as appropriate.

If an income contact is updated, the following occurs:

The income screening contact information is saved for the current member.

The member's record in the INCOMECONTACT database table is updated to reflect any changes. The CERTSTARTDATE value is not changed. The ORIGINALSCREENDATE value is set to the current system date.

If one or more Adjunctive Eligibility options are selected, a record is created for each selection in the INCOMECONTACTADJUNCTIVEITEM database table.

If one or more Adjunctive Eligibility options are cleared, each corresponding record in the INCOMECONTACTADJUNCTIVEITEM database table is deleted.

If one or more Income line items are added, a record is created for each income item in the INCOMEITEM database table.

If one or more Income line items are edited, each corresponding record in the INCOMEITEM database table is updated.

If one or more Income line items are deleted, each corresponding record in the INCOMEITEM database table is deleted.

The income screening contact information is saved for all other household members.

Each household member's record in the INCOMECONTACT database table is updated to reflect any changes. The CERTSTARTDATE value for each household member is not changed. The ORIGINALSCREENDATE value is set to the current system date.

If one or more household Adjunctive Eligibility options are selected, a record is created for each selection in the INCOMECONTACTADJUNCTIVEITEM database table for each household member.

If one or more household Adjunctive Eligibility options are cleared, each corresponding record in the INCOMECONTACTADJUNCTIVEITEM database table is deleted for each household member.

Individual Adjunctive Eligibility options selected for the member are not saved for other members of the household, but the Medicaid individual Adjunctive Eligibility option is a special case. If the member for whom it is selected has a WIC status of Pregnant or Infant, it is treated as a household Adjunctive Eligibility option, and a record is created in the INCOMECONTACTADJUNCTIVEITEM database table for each household member. However, the reverse is not true, so clearing the Medicaid individual Adjunctive Eligibility option for a member with a WIC status of Pregnant or Infant will not delete the corresponding record in the INCOMECONTACTADJUNCTIVEITEM database table for each household member.

If one or more Income line items are added, a record is created for each income item in the INCOMEITEM database table for each household member.

If one or more Income line items are edited, each corresponding record in the INCOMEITEM database table is updated for each household member.

If one or more Income line items are deleted, each corresponding record in the INCOMEITEM database table is deleted for each household member.

The Income Calculator screen is dismissed, and focus is returned to the Income History screen of the Participant Folder or the Demographic Information screen of the Certification Guided Script as appropriate.

It does not have a mnemonic. Its keyboard shortcut is the Esc (escape) key.

Depending on which screen originally called the Income Calculator screen, one of the following screens displays when the button is clicked:

Applicant Prescreening screen

Income History screen

Demographics screen

|

|

NOTE: To meet income eligibility guidelines, one of the following criteria must be satisfied:

|

If data can be validated and saved on the screen, the following processes occur when the screen is processed:

A process to check for required controls as identified in the Data Map below is performed.

A process to check for valid entries as identified individually for each applicable control in Screen Elements above is performed.

A process to check for edits and cross edits as identified for each applicable control in Screen Elements above is performed.

If any checks or processes fail, a standard error message displays.

If no data can be validated and saved on the screen:

No cross edits are performed.

All values are considered legitimate.

No data is written to the database.

The Data Map defines the values saved for all controls on the screen. If available, any additional notes or comments are displayed in the Notes column.

| Table Name: AdjunctiveIncomeEligibility | |||

|

Column Name |

Data Type |

Description |

Associated Control |

|

AdjunctiveID |

Primary Key, Int, Not NULL |

Identity Value, Identifies the adjunctive income eligibility option. |

N/A |

|

AdjunctiveType |

Int, Not NULL |

Identifies the adjunctive income eligibility option as one of the four standard types or an additional type (optional): 1 = Food Stamps 2 = TANF 3 = Medicaid 4 = FDPIR 0 = Optional |

N/A |

|

Name |

VarChar (20), Not NULL |

The name displayed for the adjunctive income option on the Income Calculator screen. |

The names of the check boxes in the Adjunctive Eligibility group box |

|

Active |

Char (1), NULL |

A yes (Y) or no (N) Boolean flag that identifies the adjunctive income eligibility option as active or inactive. |

N/A |

|

IndividualOnly |

Char (1), NULL |

A yes (Y) or no (N) Boolean flag that identifies the adjunctive income eligibility option as giving adjunctive income eligibility to the individual household member it is assigned to or the member's entire household. |

N/A |

|

CreateUserID |

VarChar (20), NULL |

Stores the UserID of the user logged into the system at the time the record was created. |

N/A |

|

CreateDTTM |

DateTime, NULL |

Stores the date and time at which the record was created. |

N/A |

|

ModifyUserID |

VarChar (20), NULL |

Stores the UserID of the user logged into the system at the time the record was modified. |

N/A |

|

ModifyDTTM |

DateTime, NULL |

Stores the date and time at which the record was modified. |

N/A |

| Table Name: IncomeContact | |||

|

Column Name |

Data Type |

Description |

Associated Control |

|

StateWICID |

Primary Key, VarChar(8), Not NULL |

The system-assigned code uniquely identifying the member within the state. |

N/A |

|

ScreenDate |

Primary Key, DateTime, Not NULL |

The date on which the income screening contact was completed. When the income contact is created, the value is populated with the system date. |

The date displayed for an income screening contact node in the Income Screening Contacts tree list. |

|

CertStartDate |

DateTime, NULL |

The start date of the certification attempt during which the record was added, if applicable. |

N/A |

|

AnnualAmount |

Numeric (8, 0), NULL |

The annualized income amount for all income sources reported for the member during this contact. |

If the INCOMEVIEWFREQ state business rule is set to "1": The dollar amount displayed for an income screening contact in the Income Screening Contacts tree list and the total amount displayed below the income information data grid. |

|

MonthlyAmount |

Numeric (8, 0), NULL |

The calculated monthly income amount for all income sources reported for the member during this contact. |

If the INCOMEVIEWFREQ state business rule is set to "12": The dollar amount displayed for an income screening contact in the Income Screening Contacts tree list and the total amount displayed below the Income Information data grid. |

|

WeeklyAmount |

Numeric (8, 0), NULL |

The calculated weekly income amount for all income sources reported for the member during this contact. |

If the INCOMEVIEWFREQ state business rule is set to "52": The dollar amount displayed for an income screening contact in the Income Screening Contacts tree list and the total amount displayed below the Income Information data grid. |

|

HouseholdSize |

Numeric (2, 0), NULL |

The size of the household at the time of the income screening contact. |

The value displayed in the Household Size text box and the household size displayed for an income screening contact node in the Income Screening Contacts tree list. |

|

PresumptiveEligibilityDate |

DateTime, NULL |

The date on which the member is presumed to be eligible for Medicaid benefits and subsequently WIC benefits. |

N/A |

|

PendingProof |

Char (1), NULL |

A flag indicating that no proof of income was provided at the time of the income screening. |

The value indicated by the Pending Proof of Income check box. |

|

TANF |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

FoodStamps |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

Medicaid |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

Other |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

FDPIR |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

TANFProofCD |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

FoodStampsProofCD |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

MedicaidProofCD |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

OtherProofCD |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

FDPIRProofCD |

Obsolete |

The repository for this data has been moved to the newly created INCOMECONTACTADJUNCTIVEITEM database table. |

N/A |

|

UpdateRecord |

Char (1), NULL |

A code indicating whether the record has been updated: N = New U = Updated NULL = Processed |

N/A |

|

CreateUserID |

VarChar (20), NULL |

Identifies the user who created the record. |

N/A |

|

CreateDTTM |

DateTime, NULL |

The date/time stamp identifying when the record was created. The value is populated with the system date. |

N/A |

|

ModifyUserID |

VarChar (20), NULL |

Identifies the user who modified the record. |

N/A |

|

ModifyDTTM |

DateTime, NULL |

The date/time stamp identifying when the record was modified. The value is populated with the system date. |

N/A |

|

OriginalScreenDate |

DateTime, NULL |

The original screening date for the income contact. When the income contact is created, the value is populated with the system date. When a previous income screening contact is copied forward, the value is populated with the OriginalScreenDate value of the copied income contact. |

The value displayed as the Original Screening Date value label for the income screening contact selected in the Income Screening Contacts tree list. |

| Table Name: IncomeItem | |||

|

Column Name |

Data Type |

Description |

Associated Control |

|

StateWICID |

Primary Key, VarChar(8), Not NULL |

The system-assigned code uniquely identifying the member within the state. |

N/A |

|

ScreenDate |

Primary Key, DateTime, Not NULL |

The date on which the income screening contact was performed. |

N/A |

|

LineItemID |

Primary Key, Numeric(10,0), Not NULL |

The system-assigned code uniquely identifying the income item. |

N/A |

|

Frequency |

Char(1), NULL |

A code indicating the frequency with which the amount of the income item is received. (Refer to the INCOMFREQ category in the Reference Dictionary database table.) |

The frequency displayed for an income line item in Frequency Column of the Income Information data grid. |

|

Amount |

Numeric(12,4). |

The amount of the income item is received. |

The amount displayed for an income line item in the Description column of the Income Information data grid. |

|

UpdateRecord |

Char (1), NULL |

A code indicating whether the record has been updated: N = New U = Updated NULL = Processed |

N/A |

|

HoursPerWeek |

Numeric(3,0), NULL |

The number of hours worked per week when the income frequency is hourly. |

The hours displayed for an income line item in the Description column of the Income Information data grid when the frequency is hourly. |

|

Duration |

Numeric(2,0), NULL |

The number of weeks, periods, or months when the income frequency is weekly, bi-weekly, monthly, or semi-monthly. |

The duration displayed for an income line item in the Description column of the Income Information data grid. |

|

ProofOfIncome |

Char (1), NULL |

A code indicating the proof of income presented for the income line item. (Refer to the INCOMPROOF category in the Reference Dictionary database table.) |

The proof of income displayed for an income screening contact node in the Income Screening Contacts tree list. |

|

CreateUserID |

VarChar (20), NULL |

Identifies the user who created the record. |

N/A |

|

CreateDTTM |

DateTime, NULL |

The date/time stamp identifying when the record was created. The value is populated with the server system date. |

N/A |

|

ModifyUserID |

VarChar (20), NULL |

Identifies the user who modified the record. |

N/A |

|

ModifyDTTM |

DateTime, NULL |

The date/time stamp identifying when the record was modified. The value is populated with the server system date. |

N/A |

| Table Name: IncomeContactAdjunctiveItem | |||

|

Column Name |

Data Type |

Description |

Associated Control |

|

StateWICID |

Primary Key, VarChar(8), Not NULL |

The system-assigned code uniquely identifying the member within the state. |

N/A |

|

ScreenDate |

Primary Key, DateTime, Not NULL |

The date on which the income screening contact was performed. |

The date displayed for an income screening contact node in the Income Screening Contacts tree list. |

|

AdjunctiveID |

Primanry Key, Int, Not NULL |

A code uniquely identifying the adjunctive income eligibility item selected. The adjunctive income eligibility item the code identifies can be found by matching the AdjunctiveID value to the value in the ADJUNCTIVETYPE column of the ADJUNCTIVEINCOMEELIGIBILITY database table. |

The identifier for the Adjunctive Eligibility check box selected. |

|

ProofCode |

Char(2), NULL |

A code uniquely identifying the proof of adjunctive eligibility presented for the income contact. The proof that the code identifies can be found by matching the ProofCode value to the value in the EXTERNALID column of the Reference Dictionary table where the value in the category column is 'FDPIRPROOF', 'MEDICAIDPROOF', 'SNAPPROOF', 'TANFPROOF', or 'OTHERPROOF', depending on the adjunctive eligibility type. |

The identifier for the Adjunctive Eligibility proof of participation selected. |

|

IndividualOnly |

Char(1), NULL |

A flag that identifies whether the adjunctive eligibility income item applies to the individual only or to all members of the member's household. |

N/A |

|

CreateUserID |

VarChar (20), NULL |

Identifies the user who created the record. |

N/A |

|

CreateDTTM |

DateTime, NULL |

The date/time stamp identifying when the record was created. The value is populated with the system date. |

N/A |

|

ModifyUserID |

VarChar (20), NULL |

Identifies the user who modified the record. |

N/A |

|

ModifyDTTM |

DateTime, NULL |

The date/time stamp identifying when the record was modified. The value is populated with the system date. |

N/A |

|

Software Version: 2.40.00