-

Display the Journal screen > Click the Import button.

Contents Show

This information includes but is not limited to individual food instrument (FI) issue and redemption and participants. Data may need to be reprocessed from month to month since FIs are issued three months advance and rejections can be overridden and paid. Some data may need to be summarized prior to import. Vendor recoveries, for instance, are to be accumulated monthly for the fifth prior issue month.

Maximum and average pricing will be derived from imported data.

The State is responsible for the integrity of the data imported into the database. The database is maintained via an import of data that could change the outcome of reports and invoices. The data will need to be tracked back to the system that generated the import files.

Data import standard error messages need to be resolved before end of month reports are run. It could change the outcome of the reports. Invalid data will be rejected and documented in a standard error message file. The data must be corrected.

The operating system will determine the look and behavior of this common screen control.

|

|

|

The file format for the import Journal File will be in an XML (Extensible Markup Language) format. The user will be responsible for creating the import Journal file. Following is an example of the XML file layout.

Financial Fund Identifier: Uniquely identifies each fund in the system. A fund is set up to help manage the accounting processes related to a funding source. This element will be a numeric field from 1 to 10 digits. This is a required field and must be an existing Financial Fund Identifier.

Financial Account Code: Uniquely identifies a financial account within the system. Financial accounts are collection points for financial activity related to a given department and program. This element will be a numeric field from 1 to 9 digits. This is a required field and must be an existing Financial Account Code linked to the selected FundCd.

Natural Account Code: Uniquely identifies a natural account within the system. Natural accounts are collection points for natural activity related to a given revenue, expense, asset or liability class. This element will be a numeric field from 1 to 6 digits. This is a required field and must be an existing Natural Account Code.

Agency Identifier: Uniquely identifies each agency within the system. This element will be an alphanumeric field from 1 to 3 digits. If valued, must be a valid agency ID.

Transaction Date: The date the related business transaction occurred. This element will be a date field in the format MM/DD/CCYY. This is a required field and must be the same month and year as the Journal entry being updated.

Transaction Type: Indicates that the related amount is to be posted as a debit or credit. This is a single alphabetic code. This is a required field and must be "C" for Credit or "D" for Debit.

Transaction Amount: This is the dollar amount to be posted to the referenced fund, financial account, natural account and agency. This element will be a numeric field. It will have the format XXXXXXXXX.XX where the first 9 digits are dollars and the last 2 digits are cents. Required field.

Transaction Description: A text description of the related business transaction. This element will be a alphabetic and special characters field. It can be up to 200 characters in length. Required field.

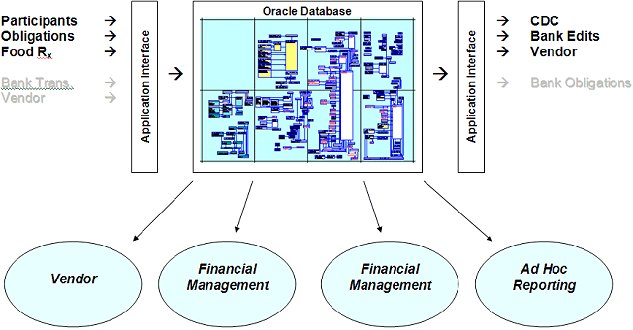

This illustration is a conceptual model of the data import/export processing.

B = Budget Accounting

A = Actual Accounting

F = Forecast Accounting

The following set illustrates an example of journal entries in the first quarter:

Open the budget books. Make an entry in the budget accounting book. Record expected funds for the fiscal year - grants awarded and rebates expected.

Set up the fund(s).

Set up the reference account.

Budget for known awards. $12,000,000 for Federal WIC Food $8,000,000 for Federal WIC NSA - Administrative

Budget for Expected Rebates. $4,000,000 in Manufacturer Rebates on Infant Formula for State WIC Food $2,000,000 in Manufacturer Rebates on Milk for State WIC Food

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

01 |

1 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICF |

B |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$12,000,000.00 |

C |

|

01 |

2 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICF |

B |

Fed WIC Pgm WIC Food |

Expense -Food |

· |

$12,000,000.00 |

D |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $12m

Expense Sub Accounts (Expense)

_____D_______C_________

$12m |

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Account Name |

Natural Account |

Agency |

Amount |

D/C |

|

02 |

1 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Revenue/ Sales/ Fund/ Rebate |

· |

$8,000,000.00 |

C |

|

02 |

2 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Salaries |

· |

$2,000,000.00 |

D |

|

02 |

3 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Fringe Benefits |

· |

$500,000.00 |

D |

|

02 |

4 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Office Space |

· |

$500,000.00 |

D |

|

02 |

5 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Telephone |

· |

$100.00 |

D |

|

02 |

6 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Printing |

· |

$300.00 |

D |

|

02 |

7 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Postage |

· |

$100.00 |

D |

|

02 |

8 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Office Equip |

· |

$500,000.00 |

D |

|

02 |

9 |

10/2000 |

10/01/2000 |

2001 Federal October Actuals |

WICN |

B |

Fed WIC Pgm NSA Admin. |

Expense - Etc. |

· |

$4,000,000.00 |

D |

Accounts Receivable (Asset)

_____D_______C_________

| $8m

Expense Sub Accounts (Expense)

_____D_______C_________

$2m |

$500t |

$500t |

$10t |

$30t |

$10t |

$500t |

$4m |

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

03 |

1 |

10/2000 |

10/01/00 |

2001 Rebate Annual Allotment - Formula |

WICF |

B |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$4,000,000.00 |

C |

|

03 |

2 |

10/2000 |

10/01/00 |

2001 Rebate Annual Allotment - Formula |

WICF |

B |

Fed WIC Pgm WIC Food |

Expense -Food |

· |

$4,000,000.00 |

D |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $4m

Expense Sub Accounts (Expense)

_____D_______C_________

$4m |

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

04 |

1 |

10/2000 |

10/01/00 |

2001 Rebate Annual Allotment - Milk |

WICF |

B |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$2,000,000.00 |

C |

|

04 |

2 |

10/2000 |

10/01/00 |

2001 Rebate Annual Allotment - Milk |

WICF |

B |

Fed WIC Pgm WIC Food |

Expense -Food |

· |

$2,000,000.00 |

D |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $2m

Expense Sub Accounts (Expense)

_____D_______C_________

$2m |

Open the Actuals Books. Make an entry in the actuals accounting book. Record expected funds for the fiscal year - grants awarded and rebates expected.

Validate the fund.

Validate the reference account.

Account for known awards. $12,000,000 for Federal WIC Food $8,000,000 for Federal WIC NSA - Administrative

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

05 |

1 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICF |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$12,000,000.00 |

D |

|

05 |

2 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICF |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$12,000,000.00 |

C |

Accounts Receivable (Asset)

_____D_______C_________

$12m |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $12m

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

06 |

1 |

10/2000 |

10/01/00 |

2001 Federal Award Annual Allotment |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Accounts Receivable |

· |

$8,000,000.00 |

D |

|

06 |

2 |

10/2000 |

10/01/00 |

2001 Federal Award Annual Allotment |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Revenue/ Sales/ Fund/ Rebate |

· |

$8,000,000.00 |

C |

Accounts Receivable (Asset)

_____D_______C_________

$8m |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $8m

Options for planning for a fund balance surplus on the opening entry. Record expected funds for the fiscal year - award and anticipated surplus.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

06 |

1 |

10/2000 |

10/01/00 |

2001 Federal Award Annual Allotment |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Accounts Receivable |

· |

$7,999,000.00 |

D |

|

06 |

1 |

10/2000 |

10/01/00 |

2001 Federal Award Annual Allotment |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Fund Balance |

· |

$1,000.00 |

D |

|

06 |

2 |

10/2000 |

10/01/00 |

2001 Federal Award Annual Allotment |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Revenue/ Sales/ Fund/ Rebate |

· |

$8,000,000.00 |

C |

Accounts Receivable (Asset)

_____D_______C_________

$7,999t |

Fund Balance Estimated Surplus (Fund Balance)

_____D_______C_________

$1t |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $8m

Open the Actuals Books. Make an entry in the actuals accounting book. Record cash allotments (draw-downs) received for this accounting period.

Validate the fund.

Validate the reference account.

Account for cash received. $3,000,000 for Federal WIC Food $1,000,000 for Federal WIC NSA - Administrative

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

07 |

1 |

10/2000 |

10/15/2000 |

2001 Federal Allotment Received - 1st Quarter |

WICF |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$3,000,000.00 |

C |

|

07 |

2 |

10/2000 |

10/15/2000 |

2001 Federal Allotment Received - 1st Quarter |

WICF |

A |

Fed WIC Pgm WIC Food |

Cash |

· |

$3,000,000.00 |

D |

Accounts Receivable (Asset)

_____D_______C_________

| $3m

Cash (Asset)

_____D_______C_________

$3m |

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

08 |

1 |

10/2000 |

10/15/2000 |

2001 Federal Allotment Received - 1st Quarter |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Accounts Receivable |

· |

$1,000,000.00 |

C |

|

08 |

2 |

10/2000 |

10/15/2000 |

2001 Federal Allotment Received - 1st Quarter |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Cash |

· |

$1,000,000.00 |

D |

Accounts Receivable (Asset)

_____D_______C_________

| $1m

Cash (Asset)

_____D_______C_________

$1m |

Open the actuals books. Make an entry in the actuals accounting book. Record Actuals Paid for this accounting period.

Validate the fund.

Validate the reference account.

Account for cash paid. $1,000,000 for Federal WIC Food $300,000 for Federal WIC NSA - Administrative

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

09 |

1 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICF |

A |

Fed WIC Pgm WIC Food |

Cash |

· |

$1,000,000.00 |

C |

|

09 |

2 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICF |

A |

Fed WIC Pgm WIC Food |

Expense - Food |

· |

$1,000,000.00 |

D |

Cash (Asset)

_____D_______C_________

| $1m

Food (Expense)

_____D_______C_________

$1m |

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

10 |

1 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Cash |

· |

$1,000,000.00 |

C |

|

10 |

2 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Salaries |

· |

$20,000.00 |

D |

|

10 |

3 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Fringe Benefits |

· |

$10,000.00 |

D |

|

10 |

4 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Office Space |

· |

$10,000.00 |

D |

|

10 |

5 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Telephone |

· |

$1,000.00 |

D |

|

10 |

6 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Printing |

· |

$8,000.00 |

D |

|

10 |

7 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Telephone |

· |

$1,000.00 |

D |

|

10 |

8 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Office Equip |

· |

$50,000.00 |

D |

|

10 |

8 |

10/2000 |

10/31/2000 |

2001 Federal October Actuals |

WICN |

A |

Fed WIC Pgm NSA Admin. |

Expense - Etc. |

· |

$900,000.00 |

D |

Cash (Asset)

_____D_______C_________

| $1m

Expense Sub Accounts (Expense)

_____D_______C_________

$20t |

$10t |

$10t |

$ 1t |

$ 8t |

$ 1t |

$50t |

$900t |

Open the Actuals Books. Make an entry in the actuals accounting book. Record rebates invoiced for this accounting period.

Validate the fund.

Validate the reference account.

Account for Rebates Invoiced for October Redemptions. $500,000 in Manufacturer Rebates for State WIC Food

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

10/2000 |

10/31/2000 |

2001 October Rebates Invoiced |

WICF |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$500,000.00 |

D |

|

11 |

2 |

10/2000 |

10/31/2000 |

2001 October Rebates Invoiced |

WICF |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$500,000.00 |

C |

Accounts Receivable (Asset)

_____D_______C_________

$500t |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $500t

Open the Actuals Books. Make an entry in the actuals accounting book. Record payment received for rebates invoiced for the accounting period.

Validate the fund.

Validate the reference account.

Account for Rebate Payment Received. $500,000 in Manufacturer Rebates for State WIC Food

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

10/2000 |

10/31/2000 |

2001 October Rebate Payment |

WICF |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$500,000.00 |

C |

|

11 |

2 |

10/2000 |

10/31/2000 |

2001 October Rebate Payment |

WICF |

A |

Fed WIC Pgm WIC Food |

Cash |

· |

$500,000.00 |

D |

Accounts Receivable (Asset)

_____D_______C_________

$500t |

Cash (Asset)

_____D_______C_________

| $500t

Open the budget books. Make an entry in the budget accounting book. Record expected funds for the fiscal year - supplemental grants awarded.

Set up the fund(s).

Set up the reference account.

Budget for known awards. $2,000,000 for Federal WIC Food

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

01 |

1 |

12/2000 |

12/15/2000 |

2001 Federal Supplemental Award Allotment - January |

WICF2 |

B |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$2,000,000.00 |

C |

|

01 |

2 |

12/2000 |

12/15/2000 |

2001 Federal Supplemental Award Allotment - January |

WICF2 |

B |

Fed WIC Pgm WIC Food |

Expense -Food |

· |

$2,000,000.00 |

D |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $2m

Expense Sub Accounts (Expense)

_____D_______C_________

$2m |

Open the Actuals Books. Make an entry in the actuals accounting book. Record funds allotted for the fiscal year - supplemental award received.

Validate the fund.

Validate the reference account.

Account for known awards. $2,000,000 for Federal WIC Food

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

05 |

1 |

1/2001 |

1/31/2001 |

2001 Federal Supplemental Allotment Received - January |

WICF2 |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$2,000,000.00 |

D |

|

05 |

2 |

1/2001 |

1/31/2001 |

2001 Federal Supplemental Allotment Received - January |

WICF2 |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$2,000,000.00 |

C |

Accounts Receivable (Asset)

_____D_______C_________

$2m |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $2m

Open the budget books. Make an entry in the budget accounting book. Record penalty assessed for the fiscal year.

Set up the fund(s).

Set up the reference account.

Account for penalty. $500,000 for Federal WIC Food.

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Account Name |

Natural Account |

Agency |

Amount |

D/C |

|

01 |

1 |

7/2001 |

7/31/2001 |

2001 Federal Penalty Award Allotment - July |

WICF2 |

B |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$2,000,000.00 |

C |

|

01 |

2 |

7/2001 |

7/31/2001 |

2001 Federal Penalty Award Allotment - July |

WICF2 |

B |

Fed WIC Pgm WIC Food |

Expense -Food |

· |

$2,000,000.00 |

D |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $2m

Expense Sub Accounts (Expense)

_____D_______C_________

$2m |

Open the Actuals Books. Make an entry in the actuals accounting book. Record penalty assessed for the fiscal year.

Validate the fund.

Validate the reference account.

Account for penalty. $500,000 for Federal WIC Food

Etc.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Account Name |

Natural Account |

Agency |

Amount |

D/C |

|

05 |

1 |

7/2001 |

7/31/2001 |

2001 Federal Penalty Allotment Received - July |

WICF3 |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$500,000.00 |

D |

|

05 |

2 |

7/2001 |

7/31/2001 |

2001 Federal Penalty Allotment Received - July |

WICF3 |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$500,000.00 |

C |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

$2m |

Accounts Receivable (Asset)

_____D_______C_________

| $2m

Set up the projections for budget worksheet with Forecast. (Forecast is used to generate the value in the projected column on the fund budget expenditures worksheet. The value could be typed into the spreadsheet in lieu of generating forecast journal entries.)

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Account Name |

Natural Account |

Agency |

Amount |

D/C |

|

01 |

1 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICF |

F |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$12,000,000.00 |

C |

|

01 |

2 |

10/2000 |

10/01/2000 |

2001 Federal Award Annual Allotment |

WICF |

F |

Fed WIC Pgm WIC Food |

Expense -Food |

· |

$12,000,000.00 |

D |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $12m

Expense Sub Accounts (Expense)

_____D_______C_________

$12m |

Receive notice of State Grant Award is similar to previous fund examples.

Validate the fund.

Validate the reference account.

Set up the budget. ($6,000,000 for Food and $3,000,000 for Administrative)

Account for award allotment received.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Account Name |

Natural Account |

Agency |

Amount |

D/C |

|

999 |

1 |

10/2000 |

10/01/00 |

2001 State Annual Allotment |

SWICF |

B |

State WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebates |

· |

$600,000.00 |

D |

|

999 |

2 |

10/2000 |

10/01/00 |

2001 State Annual Allotment |

SWICF |

B |

State WIC Pgm WIC Food |

Expense - Food |

· |

$600,000.00 |

C |

Receive notice of MIS grant award is similar to previous fund examples.

Validate the fund.

Validate the reference account.

Set up the budget. ($2,000,000 for Administrative Software)

Account for award allotment received.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Account Name |

Natural Account |

Agency |

Amount |

D/C |

|

999 |

1 |

10/2000 |

10/01/00 |

2001 MIS Annual Allotment |

MIS01 |

B |

Fed WIC Pgm WIC MIS |

Revenue/ Sales/ Fund/ Rebates |

· |

$2,000,000.00 |

D |

|

999 |

2 |

10/2000 |

10/01/00 |

2001 MIS Annual Allotment |

MIS01 |

B |

Fed WIC Pgm WIC MIS |

Admin. Software |

· |

$2,000,000.00 |

C |

Receive notice of any fund is similar to previous fund examples. (WIC, Farmer's Market Award, MIS, In-Kind, Support, etc.)

Receive actual food data regularly and summarize monthly to record the journal entry.

There is an opportunity to generate the journal entries by summarizing data from the WIC database that can be imported into the financial system

Receive actual administrative expenditures regularly from the State Department of Accounting and summarize them monthly to record the journal entries.

Open the Actuals Books. Make an entry in the actuals accounting book. Record year-end closing entries for the fiscal year. See the notes after the last close example.

Roll Balances to bring each Revenue and Cash account to zero

Surplus To Carry Forward Fund Account

Deficit To Spend Back Fund Account

Cash Account is Zero, No entry (because of draw-downs for exact amounts needed)

Etc.

Decrease A/R and Decrease Revenue for the balance of the Award Granted amount that will not be drawn from the fund.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable |

· |

$1,000.00 |

C |

|

11 |

2 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$1,000.00 |

D |

Accounts Receivable (Asset)

_____D_______C_________

| $1t

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

$1t |

OR - if a surplus was estimated:

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Fund Balance |

· |

$1,000.00 |

C |

|

11 |

2 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$1,000.00 |

D |

Fund Balance (Fund Balance)

_____D_______C_________

| $1t

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

$1t |

If cash has a debit (positive) balance, there is a surplus and cash must be set to zero:

If required, the balance may need to be returned. Credit Cash / Debit Account to Return Surplus Amount

If approved, the balance may be carried over. Credit Cash / Debit Fund Balance or Carry Forward

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Cash |

· |

$1,000.00 |

C |

|

11 |

2 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Fund Balance - Food |

· |

$1,000.00 |

D |

Cash (Asset)

_____D_______C_________

| $1t

Fund Balance (Asset)

_____D_______C_________

$1t |

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Fund Balance - Food |

· |

$1,000.00 |

C |

|

11 |

2 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Surplus |

WICF |

A |

Fed WIC Pgm WIC Food |

Carry Forward - Food |

· |

$1,000.00 |

D |

Fund Balance (Asset)

_____D_______C_________

$1t |

Carry Forward (Asset)

_____D_______C_________

| $1t

If cash has a credit (negative) balance, there is a deficit and cash must be set to zero:

If approved, the balance may be supplemented from next year's grant. Debit Cash and Credit Fund Balance or Spend Back

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close -Spend Back |

WICN |

A |

Fed WIC Pgm WIC Admin |

Cash |

· |

$5,000.00 |

D |

|

11 |

2 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Spend Back |

WICN |

A |

Fed WIC Pgm WIC Admin |

Spend Back - NSA |

· |

$5,000.00 |

C |

Cash (Asset)

_____D_______C_________

$5t |

Fund Balance = deficit balance

_____D_______C_________

| $5t

If a deficit fund balance was anticipated:

If approved, the balance may be supplemented from next year's grant. Debit Fund Balance and Credit Spend Back

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close -Spend Back |

WICN |

A |

Fed WIC Pgm WIC Admin |

Fund Balance - NSA |

· |

$5,000.00 |

D |

|

11 |

2 |

9/2001 |

9/30/2001 |

2001 Federal Fiscal Year-End Close - Spend Back |

WICFN |

A |

Fed WIC Pgm WIC Admin |

Spend Back - NSA |

· |

$5,000.00 |

C |

Fund Balance (Asset)

_____D_______C_________

$5t |

Spend Back (Liability)

_____D_______C_________

| $5t

Open the Actuals Books. Make an entry in the actuals accounting book. Record year-begin opening entries for the fiscal year for Carry Forward and Spend Back.

Carry Forward Fund Account FFY 2002

Spend Back Fund Account FFY 2002

Etc.

Carry Forward Fund:

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

10/2001 |

10/01/2001 |

2002 Federal Fiscal Year-End Begin - Carry Forward |

WICFCF |

A |

Fed WIC Pgm WIC Food |

Accounts Receivable - Food |

· |

$1,000.00 |

D |

|

11 |

2 |

10/2001 |

10/01/2001 |

2002 Federal Fiscal Year-End Begin - Carry Forward |

WICFCF |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate |

· |

$1,000.00 |

C |

Accounts Receivable (Asset)

_____D_______C_________

$1t |

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

| $1t

Accounting entry on next year's fund to show the spend back liability for the prior year's fund expenditures.

|

Jrnl ID |

Seq |

Accounting Period |

Trans Date |

Transaction Description |

Fund |

Bdgt/ Actual/ Fcast |

Financial Account |

Natural Account |

Agency |

Amount |

D/C |

|

11 |

1 |

10/2001 |

10/01/2001 |

2002 Federal Fiscal Year-End Begin - Carry Forward |

WICF |

A |

Fed WIC Pgm WIC Food |

Spend Back (A/R) - NSA |

· |

$5,000.00 |

C |

|

11 |

2 |

10/2001 |

10/01/2001 |

2002 Federal Fiscal Year-End Begin - Carry Forward |

WICF |

A |

Fed WIC Pgm WIC Food |

Revenue/ Sales/ Fund/ Rebate - Food |

· |

$5,000.00 |

D |

Spend Back (Liability)

_____D_______C_________

| $5t

Revenue/Sales/Funds/Rebates (Income)

_____D_______C_________

$5t |

Closing Fiscal Year for a Selected Fund.

** The Actual Books, Budget Books and the Forecast Books should be at zero based on planning.

The balance (Revenue minus Expenses) must be zero for expendable funds. All Asset and Liability accounts must be setting at a zero balance. Accounts Receivable and Accounts Payable must have been resolved and set to zero.

Upon approval, the Carry Forward and Spend Back Fund Balance Accounts may be used to set the fund balance to zero.

Journal entries must be made to roll asset accounts balances to zero for the closing year. The surplus estimated will not be drawn, reducing the Revenue. The cash drawn and not expended may need to be returned. The surplus or deficit fund balance, may approved for carry forward or spend back funds from the following fiscal year first period.

Outstanding issues:

Splitting expenditures between fund years.

Identify expenditures for each fiscal year and properly classify into the journal.

May need to use additional columns to generate the spreadsheet that hold up to six months after the year-end closeout month (Oct-Mar). Then total them into one "Post Period" column that is displayed in the Fund Budget Worksheet.

Projecting:

Will need use additional hidden columns to project the first month on the FNS-798.

|

Software Version: 2.40.00